Bond Calculator

About the Bond Calculator

Explanation: The Home Loan/Bond Calculator estimates your monthly home loan payments based on the loan amount, annual interest rate, and loan term. You can also include an additional monthly payment to reduce the loan balance faster. Optional costs, such as a one-time transfer fee and annual expenses like property tax and insurance, are included in the monthly breakdown for a complete view of your total monthly payments, though these additional fees don’t affect the loan balance directly.

Mathematical Formula:

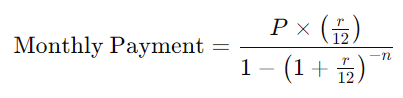

The formula used to calculate the monthly payment is:

Where:

- P = Loan Principal (Total loan amount)

- r = Monthly Interest Rate (annual rate divided by 12)

- n = Total number of payments (loan term in years × 12)

How It Works:

1. Calculate Monthly Loan Repayment: Based on the loan amount, annual interest rate, and loan term, the calculator computes the standard monthly payment for principal and interest. For instance, for a loan of $200,000 at an interest rate of 5% over 20 years, the calculator divides the annual rate by 12 for the monthly interest rate and uses the total term in months (20 × 12 = 240) to calculate the monthly payment.

2. Additional Monthly Payments: Entering an extra payment amount each month will reduce the loan’s principal faster, shortening the term and reducing the total interest paid.

3. Optional Costs:

- Transfer Fee: A one-time fee covering the legal and administrative cost of transferring property ownership, added to the initial loan amount for your reference.

- Annual Property Tax: This tax is typically a percentage of the property’s value, paid yearly but shown here as a monthly equivalent.

- Annual Insurance: Homeowner’s insurance to cover property loss or damage, also calculated annually but displayed as a monthly equivalent.

With these adjustments, you get a complete monthly payment overview, accounting for all recurring costs tied to homeownership.

Example: Suppose you take a loan of $300,000 at a 4% interest rate for 30 years. The basic monthly payment (principal and interest) is calculated based on these figures. If you add a one-time transfer fee of $2,500, this does not affect the monthly payment but is part of the overall cost. If you add $200 annually for property tax and $600 annually for insurance, these are divided by 12 to add $16.67 for property tax and $50 for insurance to the monthly estimate. So, the final monthly payment includes:

- Principal and Interest Payment

- Monthly Equivalent for Property Tax: $16.67

- Monthly Equivalent for Insurance: $50

Benefits of Additional Payments:

Adding extra to your monthly payment reduces the principal balance quicker, lowering the overall interest and allowing for an earlier payoff. Even modest extra payments can significantly impact the total cost and duration of your loan.