Interest Calculator

About the Interest Calculator

Explanation: The Interest Calculator helps you calculate how much an investment will grow over time based on an initial amount, annual interest rate, and investment period. You can also include additional monthly deposits to see how they increase the final balance. An optional compounding feature allows you to see the effect of monthly compounding, where interest is added to the balance each month, amplifying growth over time.

Mathematical Formula:

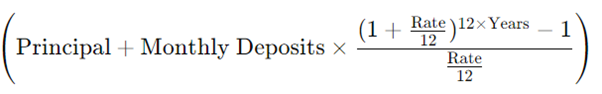

The formula for compound interest with monthly deposits is:

Where:

- Principal: Initial investment amount

- Rate: Annual interest rate (as a decimal)

- Years: Investment period in years

- Monthly Deposits: Optional extra deposits each month

How It Works:

1. Calculate Final Balance: Based on the initial amount, interest rate, and investment period, the calculator computes the final balance:

- Simple Interest: Calculates interest on the initial principal only. For example, if you invest $10,000 at a 5% annual interest rate for 10 years, with no additional monthly deposits, the interest would be $10,000 × 0.05 × 10 = $5,000, making the final balance $15,000.

- Compound Interest: When the compounding option is checked, interest is added to the principal monthly. For instance, with the same $10,000 at 5% compounded monthly over 10 years, the final balance will be higher due to interest growing each month.

2. Optional Monthly Deposits: Additional deposits increase the final balance. When included, the calculator adds these deposits to the principal each month, growing both the deposits and the interest.

Benefits of Compounding:

Compounding interest grows your balance faster than simple interest by adding earned interest back into the principal each month. This growth accelerates the longer the investment period, as each period’s interest builds upon the last.